8 Jan |

15:27 PM

When a company buys a portfolio of thousands of unpaid debts across multiple countries, it doesn’t file a separate legal motion for each one. That would cost millions and take years. Instead, it uses something called a Global Substitution Order - or GSO - a legal shortcut that lets one entity replace another in hundreds or even thousands of court cases with a single application. This isn’t science fiction. It’s happening right now in courts from London to Luxembourg, and it’s reshaping how global debt recovery works.

What Exactly Is a Global Substitution Order?

A Global Substitution Order (GSO) is a court order that allows a new party - like a debt buyer or a financial institution - to step into the shoes of the original claimant across multiple legal proceedings. It’s not about changing the debt. It’s about changing who’s legally allowed to collect it. Think of it like transferring ownership of a car: the car doesn’t change, but the title does. In legal terms, the claim stays the same, but the person enforcing it changes. The first GSO was granted in 2010 by the High Court of England and Wales to Northern Rock (Asset Management) Plc after the bank was broken up following the 2008 financial crisis. Instead of filing 12,000 individual substitution requests, they filed one. The court approved it. That single order saved millions in legal fees and cut processing time from months to weeks. Today, GSOs are routine for firms like Oaktree Capital, Apollo, and Blackstone that buy distressed debt portfolios. In 2023, Oaktree used a GSO to substitute itself in 2,457 debt collection cases after acquiring a portfolio from Deutsche Bank. Each case had its own file number, its own defendant, its own jurisdiction - but just one substitution order covered them all.How Does It Work in Practice?

The process isn’t magic. It’s strict, detailed, and requires precision. To get a GSO in England and Wales, you need three things:- A clear, legally valid assignment of the debt claims - proof you actually own them.

- A complete schedule listing every case number, court location, and defendant name.

- A plan for how you’ll notify each defendant after the order is granted.

Why the UK Leads - and Why That’s a Problem

The UK’s GSO system is the most efficient in the world. That’s why 68% of multinational debt buyers now file their first substitution request in England and Wales, even if the debtor lives in Brazil or Japan. The speed, cost savings, and predictability make it the default choice. But here’s the catch: a GSO only works in England and Wales. If you need to enforce the debt in Spain, Canada, or Australia, you have to go through their local courts again. In 2024, Deutsche Leasing AG spent €38,000 and six months just to refile substitutions in Spain after a UK GSO was rejected. That’s not a flaw in the system - it’s a gap in global enforcement. The European Union tried to fix this with Directive 2023/852, which forces member states to process bulk substitution requests within 30 business days. Before the directive, the average wait was 78 days. Now it’s faster - but still not automatic. You still need to file separately in each country. And the cost? Around €18,000 for up to 500 claims. That’s cheaper than individual filings, but still more than the UK’s GSO.

Where Other Countries Stand

The U.S. doesn’t have GSOs. Under Federal Rule of Civil Procedure 25(c), you can substitute a party after a transfer of interest - but only one case at a time. No bulk filings. That’s why U.S.-based debt buyers often outsource their international portfolios to UK firms just to use the GSO system. Germany and France require individual applications. Japan doesn’t allow bulk substitution at all. You must file a separate motion for every single claim. That’s why Japanese banks rarely sell debt portfolios overseas - the legal friction is too high. Canada and Australia are watching closely. Both have seen a spike in UK-style GSO applications from U.S. and European buyers. But neither has adopted the model yet. The concern? Due process. What if defendants never get notified?The Dark Side: When Substitution Goes Wrong

Efficiency has a price. In 2022, the case of Patel v. Capital Receivables Europe exposed a major flaw. After a GSO was granted, 317 defendants were never properly notified. 187 of them got default judgments - meaning they lost their cases without ever being told they were being sued. The Court of Appeal overturned all 187 judgments. The firm was fined. And the legal community was shaken. The International Bar Association found that 12% of GSO applications in 2023-2024 didn’t include proof of post-order notice. That’s not negligence - it’s systemic. Some firms treat the GSO as a one-time approval, not a two-step process: get the order, then tell everyone. The fix? Mandatory verification. New rules in 2025 require firms to submit signed affidavits proving notice was sent to every defendant - by registered mail, email, or court-approved service. Failure means the GSO is revoked.The Future: Blockchain, AI, and the Digital Substitution Order

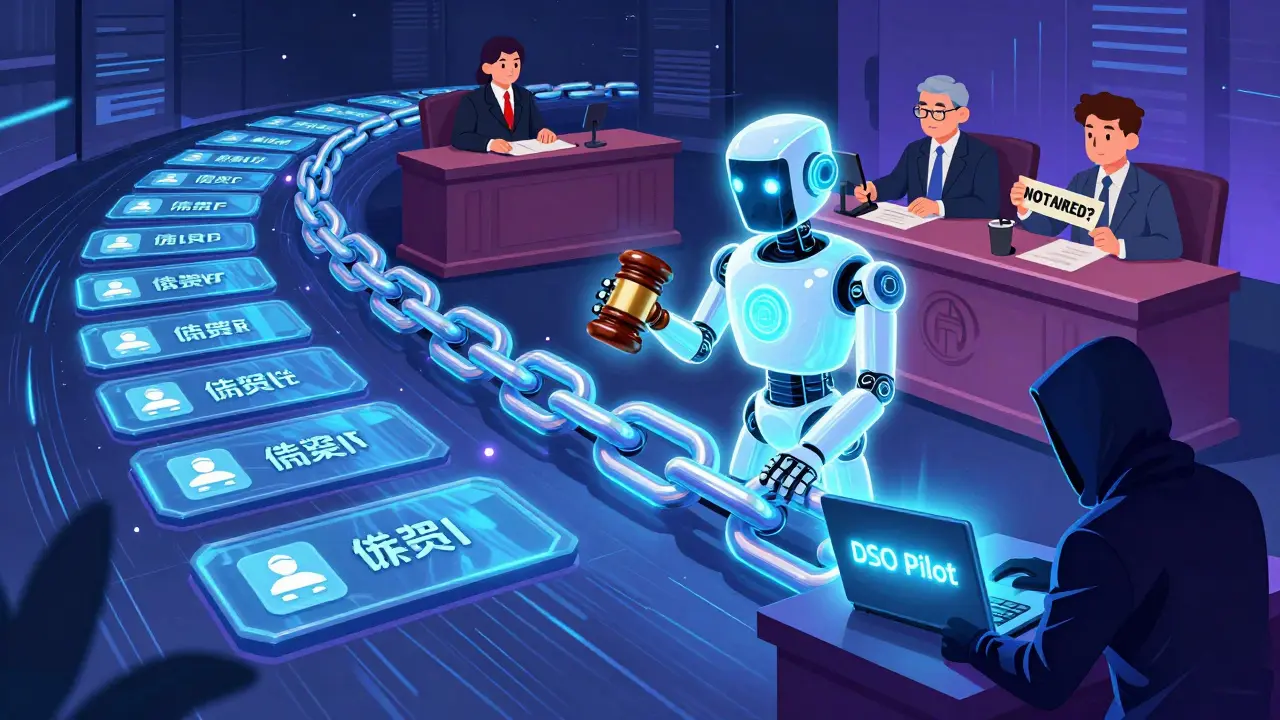

The next leap isn’t legal - it’s technological. In July 2025, the UK launched the Digital Substitution Order (DSO) pilot. It uses blockchain to automatically update case management systems across courts when a GSO is approved. No manual updates. No lost files. No delays. Initial results? A 40% drop in processing time. And it’s not just the UK. The Hague Conference is drafting a 2025 Convention on Cross-Border Recognition of Substitution Orders. If adopted, it could make GSOs enforceable in over 80 countries. AI is coming too. Deloitte predicts that by 2027, 75% of major debt portfolio acquisitions will use automated substitution tools. These systems pull data from loan files, match case numbers, generate schedules, and even draft court filings. One firm in London now uses AI to process 30 GSOs per month - a task that used to take a team of five lawyers six weeks. But there’s risk. In March 2025, a UK litigation finance firm’s GSO platform was hacked. 12,843 debtor records were leaked. GDPR fines followed. Now, cybersecurity is part of every GSO application.

10 Comments

This is wild. I had no idea one order could replace thousands of lawsuits. It’s like legal Netflix-stream everything at once. But… what if someone doesn’t even know they’re being sued? That’s not efficiency, that’s a trap.

My cousin got a judgment last year and never got a letter. She only found out when her bank account got frozen. This system feels like it’s built for corporations, not people.

I’m not against collecting debt-I’m against hiding behind paperwork to do it.

OMG I JUST REALIZED THIS IS WHY I GOT SUED IN 2022 AND NEVER GOT NOTIFIED 😭😭😭

THEY TOOK MY CAR. I DIDN’T EVEN KNOW I WAS BEING SUED. THIS IS A SCAM. I’M CALLING MY LAWYER. #GSOISABUSINESSMODELNOTAJUSTICEMODEL 💥⚖️

Let’s take a step back. This isn’t just about debt-it’s about access to justice. The UK’s GSO system is brilliant for scale, but scale without accountability is just automation of harm.

Imagine being a single mom in Spain with a $300 debt. You get a default judgment because a British firm used a GSO and never mailed you anything. You lose your job. Your credit is destroyed. And the firm? They moved on to the next portfolio.

We need global standards. Not just speed. Not just cost-cutting. We need dignity. And notice. And consequences for skipping steps.

This isn’t anti-business. It’s pro-human.

Look, I get the fearmongering. But let’s be real-debt buyers aren’t villains. They’re the ones cleaning up the mess banks left behind. Without them, those debts just rot on balance sheets and never get paid. No one benefits from that.

The GSO is just smart logistics. If you’re going to buy 2,457 debts, you’re not filing 2,457 motions. That’s not greed-that’s capitalism. And frankly, if you can’t keep track of your own debts, maybe you shouldn’t have borrowed in the first place.

Also, the fact that 92% of applications get approved means the courts aren’t asleep at the wheel. They’re just efficient. Maybe we should try that in other areas.

And yes, notice matters. But the 2025 affidavit rule fixes that. Problem solved. Move on.

So let me get this straight-Western legal systems are outsourcing their judicial sovereignty to a bunch of hedge funds using London as a legal shell? This is the end of national jurisprudence. The EU’s 30-day rule is a Band-Aid. The real issue is the erosion of territorial legal authority.

Germany doesn’t have GSOs because we still believe in due process. France doesn’t because they don’t want to become a financial colony. And the U.S.? Too afraid to admit their system is broken.

This isn’t innovation. It’s legal colonialism. The UK isn’t leading-it’s exporting a predatory model. And now they’re slapping blockchain on it like it’s a virtue. Blockchain doesn’t fix moral failure.

Who’s auditing the auditors? Who’s holding the AI that drafts these filings accountable? Nobody. And that’s the real scandal.

I think both sides are missing the middle ground. The GSO is a tool. Tools aren’t good or bad-they’re used well or poorly.

The real problem isn’t the order itself-it’s the lack of global enforcement of notice. The UK has the best system, but if other countries won’t recognize it or enforce the notice rules, then we’re just playing legal whack-a-mole.

What if we created a global registry? Every GSO gets logged on a public, blockchain-backed ledger. Defendants get automated SMS/email alerts. Courts get real-time updates. Firms get penalties if they skip verification.

It’s not magic. It’s just coordination. And honestly? We’ve done this with passports, flight data, even credit scores. Why not debt?

I live in India. My uncle got a letter from a UK firm saying he owed $1,200 from a credit card he never used. He’s 72. He doesn’t speak English. He didn’t know what to do. The court in Delhi didn’t recognize the GSO. The firm kept sending emails. He cried for weeks.

They say it’s efficient. But efficiency doesn’t care if you’re old. Or poor. Or scared.

Why does the world keep building systems that work for people who already have lawyers and internet access? Why not build one that works for the ones who don’t?

I’m not angry. I’m just… tired. Tired of being invisible to the systems that control my life.

And now they’re using AI to make it faster. That’s not progress. That’s erasure.

Let’s quantify the fraud. 12% of GSOs lack proof of notice? That’s 1 in 8 cases where someone got defaulted without ever knowing. That’s not a glitch-that’s a feature of the business model.

And now they’re using AI to automate the filing? Great. So now you can scale injustice at 30 GSOs/month instead of 3.

Here’s the real KPI: % of judgments overturned on appeal due to lack of notice. That’s the metric that matters. Not processing time. Not cost savings. Not blockchain.

Deloitte’s prediction? 75% of portfolios using AI substitution by 2027? That’s not innovation. That’s a death spiral for due process.

And don’t get me started on the 12,843 records leaked. That’s not a hack. That’s a data breach waiting to happen because they didn’t encrypt debtor data because ‘it wasn’t required.’

Wake up. This isn’t finance. It’s legal predatory tech.

Everyone’s talking about efficiency, but no one’s talking about the soul of justice. Debt isn’t just numbers-it’s people’s lives. A mother skipping meals. A student dropping out. A veteran hiding from collectors.

Using a GSO to sweep hundreds of cases under one order? That’s not legal innovation. That’s moral laziness.

And now you want to use AI to make it faster? So we can collect faster and care less?

I’m not saying we shouldn’t collect debt. I’m saying we shouldn’t pretend we’re being fair while we’re running a legal assembly line.

Justice isn’t a cost center. It’s the foundation. And right now, we’re tearing it down to save $10,000 per portfolio.

What if the GSO isn’t the problem? What if it’s the only thing keeping the system from collapsing entirely?

We live in a global economy. Debts move across borders faster than laws can catch up. The UK didn’t invent this-it just built the first bridge. The rest of the world is still building theirs.

Yes, notice failures happened. But the 2025 affidavit rule is the correction, not the failure. And blockchain? It’s not a gimmick-it’s transparency. Every step recorded. Every notice timestamped. No more ‘we sent it’ without proof.

The real threat isn’t the GSO. It’s the idea that justice can’t be scaled. That we have to choose between fairness and efficiency. We don’t. We just have to design better systems.

Let’s not throw out the tool because someone misused it. Let’s fix the misuse. And then use the tool to do more good than harm.

Because if we don’t, the next generation will inherit a world where debt is either invisible… or inescapable. Neither is justice.