The Real Price Tag: How Do Mail-Order and Local Pharmacies Stack Up on Synthroid?

Digging into the cost of Synthroid savings for a 90-day supply? It’s not as simple as checking which place is “cheaper” on paper. Prices bounce around depending on insurance coverage, cash pay discounts, time of year, and even which location you visit. Right now, a 90-day supply of Synthroid (let’s take the common 100mcg dose as an example) swings dramatically in price at different outlets. Walk into a big chain pharmacy like CVS or Walgreens and you might see that three-month bottle for anywhere from $110 to $160. Smaller independent pharmacies, especially ones with a loyal customer base, sometimes price-match—although they can also land even higher because they’re buying in smaller quantities.

Now look at mail-order pharmacy options. If your insurance plan nudges you this direction, you could see prices as low as $65 for the same three-month supply. Some plans, like those managed by Express Scripts or OptumRx, negotiate even sweeter deals, so your out-of-pocket might drop under $50—if you’re enrolled, of course. Without insurance, it’s a different ballgame: cash prices for mail orders through GoodRx or online retailers often hit anywhere between $70 and $140, and the pricing can change daily based on stock and negotiated supplier deals. There are also international online pharmacies now popping up, hinting at even bigger discounts—though there’s always a risk factor, and you’ll want to be sure they’re legitimate.

Let’s cut through the chaos with some actual price snapshots, rounded as of early 2025:

| Provider | 90-Day Synthroid (100mcg) | Notes |

|---|---|---|

| CVS (in-store) | $150 | Cash price, may lower with coupons |

| Walgreens (in-store) | $140 | Club membership may lower cost |

| Walmart (in-store) | $115 | Generic equivalent can be cheaper |

| Express Scripts (mail-order, insured) | $49 | With Aetna, UHC, others |

| OptumRx (mail-order, insured) | $59 | Depends on plan |

| Costco Mail Order (cash pay) | $85 | Membership required |

| GoodRx Gold (mail, cash pay) | $72 | Varies by pharmacy |

That’s a lot of numbers. The short version? Mail-order routes are almost always cheaper if you have decent insurance or a flexible HSA. But there are exceptions, and coupon programs sometimes make your corner pharmacy surprisingly competitive—especially if you’re persistent and know when to ask.

Why Do Mail-Order Pharmacies Usually Cost Less?

It’s easy to roll your eyes at the slick marketing, but there’s a real reason mail-order pharmacies (especially those tied to big insurers or PBMs) can offer *much* lower prices. These companies are buying in wild bulk. Imagine someone walking into Costco and clearing out an entire pallet of cereal—except on a scale of thousands of pounds. Bulk purchasing knocks the price per tablet way down. Plus, there are fewer costs: no need to keep a sprawling retail staff, light bills, or prime street locations. They ship from a warehouse—simple, efficient.

Mail-order also locks you into a routine. Pharmacies sending out mass scripts every 90 days can plan their inventory, nearly eliminate waste, and negotiate better rates with manufacturers. This is why your doctor’s portal might keep nudging you to use the insurer-approved mail service: it literally shaves percentage points off your health plan’s costs, and if they pass some of it to you, you see lower copays, too.

Local pharmacies, though? They can’t come close on volume. Even the busiest Walgreens runs through maybe dozens, not thousands, of Synthroid bottles a day. Their wholesale cost is higher, and they often eat the difference or pass it to you unless you have a coupon. Plus, their overhead—rent in a strip mall, payroll, fridges for specialty meds—doesn’t magically disappear just because you want a deal on thyroid pills.

But local shops can be more nimble when it comes to discounts if you ask. Some are authorized to lower cash prices if you show them a competing GoodRx offer on your phone, for example. And sometimes, they’ll price match their own online mail-order partner—so you get the best of both worlds: a local face, national chain price.

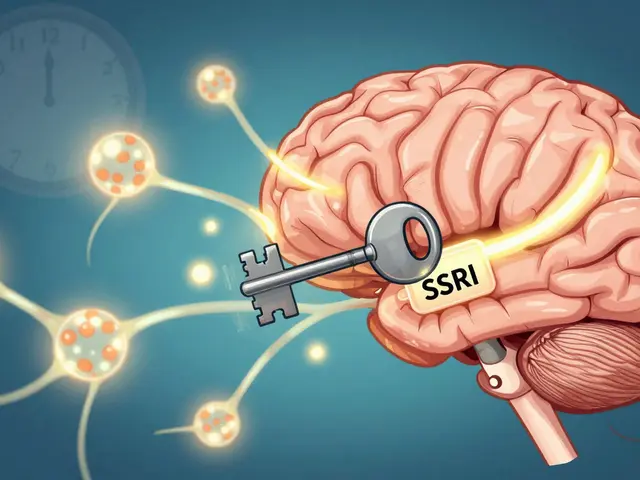

Hidden Savings Hacks: Tips for Getting the Best Synthroid Deal

Got insurance? Before you do anything, check the mail you get from your health plan. Sometimes, stolen in the fine print, there’s an announcement that you only get your lowest rate on Synthroid if you use their mail-order service. That’s by design. Anthem, BCBS, UnitedHealthcare, and others routinely funnel customers to their preferred mail providers for top discounts, sometimes as much as 50% lower than what you’d pay in person. So, if you skip that step, you could literally be overpaying.

No insurance? You still have wiggle-room. GoodRx and SingleCare both have free coupon programs that are honored at tons of local spots. Cash copay programs (sometimes run by the drug manufacturer) can bring your 90-day supply down to just $80 or less, especially if you use the generic levothyroxine. Don’t forget to ask your local pharmacist if they accept these coupons—they often do, but it can depend on location.

Truth is, for some people, even the best-known coupons don’t get Synthroid below $100 for three months. That’s where searching for a discount on Synthroid through international pharmacist partners can sometimes tip the balance—though you absolutely need to verify where your pills are coming from. Some online pharmacies are run by actual brick-and-mortar Canadian stores (which are generally safe and tightly regulated), while others might be drop-shipping from overseas. A good litmus test: Check their licensing, look for recent reviews, and always confirm the medication batch number and origin when your delivery arrives.

Remember, splitting pills is rarely recommended for Synthroid (since it’s a precise thyroid hormone), but sometimes your doctor can prescribe a higher dosage at the same price per bottle, saving you cash—so don’t be afraid to ask.

Small but real trick: If you have an FSA or HSA card, see if it auto-approves online or mail-order purchases. These funds are tax-free, and most major pharmacies accept HSA as payment on their digital checkouts—helping you save by reducing your taxable income.

Convenience Versus Cost: When Is Local Pharmacy the Better Move?

Here’s the twist: Cheaper doesn’t always mean “better,” especially if you’re juggling a busy life, unpredictable schedules, or frequent dosing changes. At my house, when my kid Sage needed a dose tweak, we couldn’t wait a week for a mail-order fix. Local pharmacies jump to it fast. Sometimes they’ll even work with your doctor to get you the right script before you can say ‘thyroid crash.’

Face-to-face advice is also pretty underrated. Try asking a chat bot if you’re having weird side effects—chances are you’ll get a generic, copy-pasted response. Compare that to a pharmacist who’ll actually remember your profile. Seriously, some of them go out of their way, especially at independent stores, to keep tabs on refills, catch dose errors, and even call when you skip a pick-up. There’s value in not being just another name in a database.

Local stores are also a lifeline when the insurance claim doesn’t go through or you lose a prescription. You can troubleshoot in person, sometimes with minutes to spare if you’re down to your last tablet. Mail-order systems can be slow to resolve issues, and if your med gets lost in transit, well—good luck.

For some folks, community counts. Maybe you want to support local businesses, or maybe you just like to see the same faces each month. If you’re willing to hunt for deals and use every coupon in your arsenal, you might come out even or slightly ahead, all without the delivery wait or impersonal service.

Making the Right Choice for Your Synthroid Needs

So, what’s the best move for mail-order pharmacy versus local pharmacy when it comes to your 90-day Synthroid script? Kinda depends on your life situation, insurance plan, and how much you value speed or face-to-face service. If your budget runs tight and you’re okay waiting for shipping, mail-order nearly always comes out cheaper—especially when you have a health plan that rewards you for it. Those using HSAs, FSAs, or certain Medicare drug plans will probably wring the most value by going mail-order, thanks to negotiated prices and built-in tax perks.

But don’t sleep on local bargains. Have a complex medication history, expect to change doses, or want someone who’ll spot check your scripts for errors? There’s a strong case for paying a little extra at your neighborhood pharmacy. Especially if you can double-dip with club memberships, local cash discounts, and new-patient incentives.

Remember: always ask about current deals, price matching, and any available generic versions. Pharmacies—both online and in person—are hungry for your business and often have unpublished specials for persistent shoppers. Shopping around every six months can feel like a hassle, but it pays off. The system is rarely static; pricing shifts sometimes *weekly* based on supply and insurer deals.

Quick bonus: New savings programs are popping up all the time. Voice-activated prescription reminders, instant rebate apps, and hybrid “click and collect” options could soon combine the best of both worlds. Stay curious, keep pressing for the lowest price, and use your options as leverage—whether that’s a virtual checkout cart or your trusty pharmacist down the block.

17 Comments

Hey folks, just wanted to point out that many mail‑order programs actually require you to enroll in the plan’s pharmacy network before you can snag that $49 price – otherwise you’ll end up paying the full retail rate. It’s a tiny step that saves a lot, so grab your insurance portal, check the “preferred pharmacy” box, and you’ll see the discount right away. Also, don’t forget to ask your local pharmacist if they’ll match that price when you show them a GoodRx screenshot – they’ll often do it for a friendly regular. You can also look for a coupon code that definatly drops the price a few bucks more.

It is absolutely reprehensible that anyone would sacrifice their health for a few dollars when the insurance companies themselves orchestrate these price gouging schemes. The moral bankruptcy of the pharmaceutical industry is on full display when they hide genuine savings behind convoluted mail‑order portals, forcing patients to navigate a labyrinth of red tape. If you truly care about your well‑being, demand transparency and refuse to be a pawn in their profit‑driven game.

💡 Let’s break this down: mail‑order pharmacies cut costs because they buy in bulk, eliminating the overhead of brick‑and‑mortar stores. That’s why you see a 60‑70 % price drop compared to a typical CVS checkout. 🌐 If you’ve got a flexible HSA or FSA, use it to pay for the mail‑order order – the tax‑free benefit amplifies the savings. And remember, you can always double‑check the price on GoodRx before you commit, just to make sure you’re not paying extra. 😊

Listen, I’ve been in that exact spot where my thyroid medication ran low and the mail‑order shipment got delayed – I felt the panic surge, but the local pharmacist saved the day by giving me a temporary supply. It’s not just about the numbers; it’s about having a human who knows your routine and can intervene when the system fails. So, while the spreadsheets whisper “cheaper mail‑order,” remember the real‑life impact when a delivery van hits traffic.

That human touch can be worth every extra cent.

Picture this: a bustling pharmacy aisle, fluorescent lights buzzing, and you’re clutching a price tag that reads $150 for three months of Synthroid. Now imagine a sleek, silent warehouse where the same pill slides onto a conveyor, emerging with a $49 label – it’s a cinematic contrast of excess versus efficiency. The bulk‑buying behemoths rewrite the script, turning what used to be a pricey drama into a budget‑friendly comedy.

From a practical standpoint, checking both your insurer’s mail‑order portal and local pharmacy coupons can often reveal a hidden overlap where you qualify for a rebate on top of a discounted cash price. It may require a couple of phone calls, but the net savings usually justify the effort, especially for a medication you take continuously.

Oh sure, let’s all jump on the mail‑order bandwagon while ignoring the simple fact that our own country’s pharmacies are being gutted by foreign drug conglomerates. Nothing says “patriotism” like sending your thyroid meds across state lines just to keep the American small‑business pharmacist out of a job. If you think saving a few bucks is noble, maybe you should start by buying domestically produced meds and supporting the local economy.

They don’t want you to know that the “low price” mail‑order deals are actually a front for tracking your prescription habits and feeding data straight to the big pharma overlords. Every click you make adds to a hidden ledger that fuels the next price hike, so the only real safety is to stick with a local pharmacy that isn’t part of that secret network.

Cost variance analysis indicates a 35‑45% discount differential between PBM‑mediated mail‑order and retail dispense models, contingent upon formulary tier placement and patient copayment elasticity.

While the quantitative data clearly shows a lower average out‑of‑pocket expense for mail‑order channels, it’s essential to weigh the qualitative aspects such as medication adherence risk when delivery delays occur. I encourage you to conduct a personal risk‑benefit assessment, factoring in your schedule flexibility and the reliability of your chosen provider.

If you have an HSA or FSA, definitely use it for your mail‑order purchase!!! This not only reduces your taxable income, but also effectively lowers the net cost of your Synthroid supply!!! Additionally, many insurers offer a “preferred pharmacy” discount that you can stack with manufacturer coupons!!! Don’t forget to verify that your pharmacy’s discount program is still active before you place the order!!!

From a cultural perspective, the convenience of home delivery aligns with the growing preference for digital health services, yet the tactile reassurance of an in‑person pharmacist interaction remains a valued tradition in many communities.

It is imperative that patients understand the fiscal implications of their pharmacy choices; by choosing a mail‑order service that is integrated with their insurance, they can achieve substantial savings that far outweigh the marginal inconvenience of delayed delivery.

When evaluating the total cost of a 90‑day Synthroid regimen, it is insufficient to consider only the nominal retail price advertised at the point of sale. One must incorporate the ancillary variables of pharmacy benefit manager (PBM) negotiation leverage, formulary tier placement, and patient cost‑sharing structures, each of which can exert a pronounced effect on the final out‑of‑pocket expenditure. Empirical data collected across multiple health plans in 2024 demonstrate that mail‑order pharmacies, when operating under a contractual agreement with a PBM, can secure acquisition costs that are 30 to 45 percent lower than those incurred by community pharmacies purchasing through traditional wholesale channels. This differential is primarily attributable to volume‑based pricing models, wherein the mail‑order entity aggregates prescriptions across a broad enrollee base, thereby achieving economies of scale that are inaccessible to smaller retail outlets. Moreover, the logistical infrastructure of centralized distribution centers reduces ancillary overhead costs such as shelf‑space rental, in‑store labor, and utility expenditures, further compressing the net cost to the insurer and, by extension, to the patient. However, this cost advantage is not universally guaranteed; variations in plan design, such as the presence of a step‑therapy requirement or a high‑deductible health plan, can diminish the realized savings for some beneficiaries. In parallel, local pharmacies retain a strategic advantage in providing immediate access to medication, enabling rapid dose adjustments and offering personalized counseling that can enhance therapeutic adherence. The qualitative benefit of face‑to‑face interaction may mitigate indirect costs associated with medication non‑adherence, such as increased clinical visits or hospitalizations, which are often underappreciated in a pure price comparison. Consequently, a comprehensive cost‑effectiveness analysis must integrate both direct monetary outlays and indirect health outcomes to determine the optimal acquisition channel for each individual. Patients with stable dosing regimens and reliable insurance coverage that includes a mail‑order preference are likely to achieve maximal financial benefit by leveraging the bulk‑purchase discounts. Conversely, those with complex therapeutic needs, frequent dosing changes, or limited insurer mail‑order networks may find that the marginal premium paid at a local pharmacy translates into superior clinical continuity. It is also prudent to monitor periodic fluctuations in drug pricing, as market dynamics such as generic entry or supply chain disruptions can rapidly alter the cost landscape. Regularly reviewing pharmacy statements, comparing manufacturer coupons, and engaging in price‑matching negotiations with local retailers can sustain competitive pricing over time. In summary, while mail‑order pharmacies often present the lowest headline price, a nuanced appraisal that balances economic, clinical, and logistical factors is essential for informed decision‑making.

Both models have their merits; mail‑order offers predictable pricing and convenience, while a neighborhood pharmacy provides rapid service and personal attention, so the best choice depends on your individual priorities.

I’ve tried both and love the savings from mail‑order, but there’s nothing like picking up my prescription and chatting with the pharmacist 😊. It’s a nice balance!

Local pharmacy wins for me 😊